wisepowder's blog

Because the pricing of crude oil is made in American dollars internationally, changes in oil price directly affect the exchange rates of the countries. This point especially led the researches about the effects of oil price changes to focus on its effects over exchange rates.

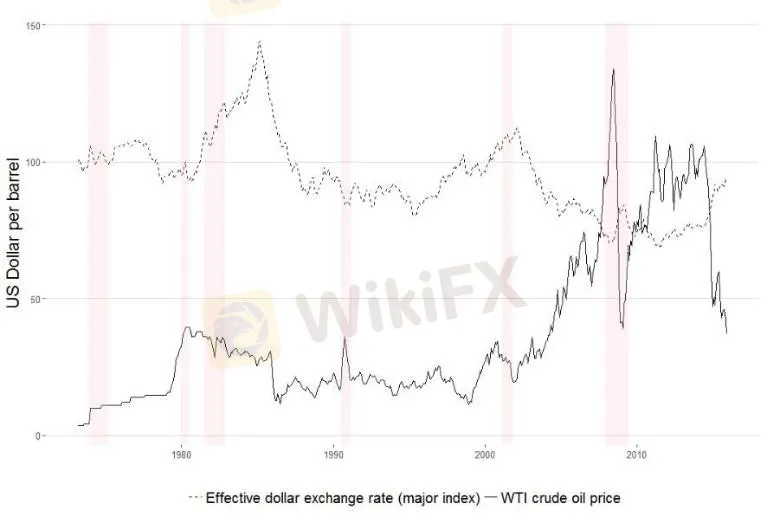

Policymakers, academics and journalists have frequently discussed the link between oil prices and exchange rates in recent years—particularly the idea that an appreciation of the US dollar triggers a dip in oil prices. Empirical research is not so clear on the direction of causation, as there is evidence for bi-directional causality. Some studies find that an increase in the real oil price actually results in a real appreciation of the US dollar, while others show that a nominal appreciation of the US dollar triggers decreases in the oil price. Figure 1 illustrates the link between the nominal West Texas Intermediate (WTI) crude oil price and the US effective dollar exchange rate index relative to its main 7 trading partners.

The terms of trade channel mostly focus on real oil prices and exchange rates, while the wealth and portfolio channels propose an effect from the nominal exchange rate to the nominal oil price. The expectations channel allows for nominal causalities in both directions.

1. The impact of oil prices on exchange rates

The terms of trade channel were introduced in 1998. The underlying idea is to link the price of oil to the price level which affects the real exchange rate. If the non-tradable sector of a country A is more energy intensive than the tradable one, the output price of this sector will increase relative to the output price of country B. This implies that the currency of country A experiences a real appreciation due to higher inflation. Effects on the nominal exchange rate arise if the price of tradable goods is no longer assumed to be fixed. In this case, inflation and nominal exchange rate dynamics are related via purchasing power parity (PPP). If the price of oil increases, we expect currencies of countries with large oil dependence in the tradable sector to depreciate due to higher inflation. The response of the real exchange rate then depends on how the nominal exchange rate changes, but relative to the impact of any changes in the price of tradable (and non-tradable) goods described above. Overall, causality embedded in the terms of trade channel potentially holds over different horizons depending on the adjustment of prices.

The underlying idea of the portfolio and wealth channel is based on a three country framework. The basic idea is that oil-exporting countries experience a wealth transfer if the oil price rises. The wealth channel reflects the resulting short-run effect, while the portfolio channel assesses medium- and long-run impacts. When oil prices rise, wealth is transferred to oil-exporting countries (in US dollar terms) and is reflected as an improvement in exports and the current account balance in domestic currency terms. For this reason, we expect currencies of oil-exporting countries to appreciate and currencies of oil-importers to depreciate in effective terms after a rise in oil prices. There is also the possibility that the US dollar appreciates in the short-run because of the wealth effect - if oil-exporting countries reinvest their revenues in US dollar assets. The short and medium-run effects on the US dollar relative to currencies of oil-exporters will depend on two factors according to the portfolio effect. The first is the dependence of the United States on oil imports relative to the share of US exports to oil-producing countries. The second is oil exporters relative preferences for US dollar assets. Figure 3 summarizes the wealth and portfolio channels.

2. Common factors driving oil prices and exchange rates

Having already explained the role of inflation, Figure 2 incorporates other common factors including GDP, interest rates, stock prices and uncertainty. A full analysis of all possible linkages and other potential factors is beyond the scope of this paper, but a few important channels are worth mentioning. GDP and interest rates both affect exchange rates and oil prices, and are also interrelated: Monetary policy reacts to GDP fluctuations while interest rate changes affect GDP through total investment and spending. An increase in GDP, all else equal, results in an increase in the oil price. Effects on exchange rates are less clear for both interest and exchange rates. A relative increase in domestic interest rates should for example depreciate the domestic currency according to uncovered interest rate parity, but the empirical evidence has demonstrated that an appreciation is frequently observed instead, reflecting the notorious forward premium puzzle. Another major influence on both the macroeconomic environment and exchange rate dynamics is the degree of uncertainty. A domestic appreciation of the exchange rate might result from uncertainty, if participants expect a currency to act as a safe haven.

Under the theories explaining the relationship between oil price and exchange rate, we see the basic supply-demand relationship. When the price of oil increases, firstly demand for dollar will increase in oil importing countries leading dollar to appreciate, but then to buy the dollar their demand for their local currencies will increase leading appreciation of their local currencies, which causes the exchange rate to depreciate. Also after getting the payment, the supply of dollar will increase in oil-exporting countries leading dollar to depreciate which causes a decrease in exchange rate, but here there are two possible follow up situations. If the oil-exporting country increases their goods import because of the depreciation of dollar, demand for the dollar will increase in the country leading dollar to appreciate causing an increase in exchange rate. However, if the oil-exporting country can‘t/doesn’t increase their goods import, then exchange rate will remain in a decreasing trend because of the depreciation of dollar.

Researchers built a theoretical dynamic partial-equilibrium portfolio model of an oil price increase influence on exchange rates in a world consisting three countries: United States of America, Germany and OPEC. According to this model, the short-run and the long-run effects of the oil price increase will be opposite such as an increase in oil price at first induces dollar appreciation but then it turns into dollar depreciation. The effect of an oil price increase on exchange rate depends on “the share of local currency in OPEC‘s portfolio”, “the share of country’s goods in OPEC imports”, and “the country‘s share in world oil imports” in this model. In the model oil imports are exogenously fixed so the effect of oil price increase will also be affected by the OPEC’s spending preferences of the money generated from oil sales. For instance; if OPEC prefers dollar payment but German goods, then the value of dollar will increase in the short-run, however will decrease in the long-run.

The most important event of the week will take place in the House of Commons. On Monday, MPs began debating changes to the Withdrawal Agreement as the amendments have riled the EU and caused heated debate within the Conservative Party.

The UK's employment/unemployment figures for July will be released at 14:00 today, while at the same time tomorrow the CPI for August will have come out. The data is expected to show price pressures easing, on which the BoE is likely to discuss at their meeting the next day.

Bullish price action from the end of June was comprehensively broken last week and there is little support before the 200-DMA. With volatility picking-up over the last few weeks as well as the releases of previously mentioned events and data, the pound may stage a volatile performance this week.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

The outbreak and spread of COVID-19 caused oil prices to plummet, with futures prices dropping to a negative value for the first time in history. The demand for energy consumption fell sharply mainly due to governments‘ measures of lockdown and social distancing orders that restricted people to travel and put countries’ aviation industry into a battle to survive.

The International Energy Agency (IEA) forecasts global oil demand will decrease by an average of 8 million barrels/day this year, or about 8% lower than last year. Although the IEA estimates oil demand will increase by 5.7 million barrels/day next year, overall demand will remain lower than in 2019 due to ongoing uncertainty in the aviation sector.

This gloomy outlook has made many observers question whether market demand can return to 2019 levels? The concept of oil at its peak has long been the subject of discussion. Experts mainly focus on production peaks, with forecasts that oil prices will skyrocket when underground oil resources are exhausted.

But in recent months, the concept of a demand peak has emerged, after the COVID-19 pandemic wiped out the fuel demand of the transport industry, plus those efforts to move to cleaner fuel sources. Environmental groups have been campaigning to stop the Paris Agreement on climate change from becoming another victim of the COVID-19 pandemic, said Professor Michael Bradshaw at the Warwick Business School (UK), at the same time emphasized the need for a Green New Deal in the economic recovery process.

Professor Bradshaw argues that if environmental groups succeed, demand for “black gold” may never return to the highest levels ever recorded before the COVID-19 pandemic. Meanwhile, the transport sector may never fully recover, and after a pandemic, people may have different attitudes toward international air travel or work habits.

According to IEA CEO Fatih Birol, many people including CEOs of several large companies think that with today's lifestyle changes, oil demand may have peaked and will begin to drop. Meanwhile, the oil industry may face financial challenges.

Bronwen Tucker, an analyst at the non-governmental organization Oil Change International (OCI), said the oil industry is under great pressure from investors. “The giant” Royal Dutch Shell (UK-Netherlands) said last week that the asset value of this business has decreased by about 22 billion USD when reassessing the value of the business under the influence of COVID-19. Last month, Britain's BP also announced the net worth of the oil and gas conglomerate decreased by $ 17.5 billion. While China actively buys crude oil when it is so cheap and so that the tanker congestion has formed at sea.

China is currently the world's second largest oil consumer after the US. As of June 29, the country has accumulated 73 million barrels of oil, which is stored in 59 ships floating at sea, according to data from ClipperData - the company tracks the movement of crude oil at sea in real time. This is equivalent to three-quarters of the world's demand.

The recently landed oil was probably purchased in March and April, when oil prices plummeted due to the pandemic. WTI US crude oil dropped to negative on April 20 for the first time in history.

China's floating oil storage - which includes barrels of oil waiting on board for seven days or more - has nearly quadrupled since the end of May, according to ClipperData. This is not only a record number since the beginning of 2015, but also 7 times higher than the monthly average in the first quarter of 2020.

The storage of oil at sea shows that China is making a profit when the world energy market falls into a period of extreme crisis. “China is buying massive globally,” said Matt Smith, director of cargo strategy at ClipperData. “The number of oil at sea is growing rapidly.”

Smith also said China's inland oil depots were not even filled yet. “This was simply due to an out-of-port congestion. So many tankers arrived that they couldn't bring it ashore in time,” he explained.

The main buying power of China has partly pulled up the oil market. Just 7 weeks after falling to a negative of nearly $40, US crude oil rose again to $40 a barrel. The difference of 80 cent USD was created by the unprecedented reduction in production by OPEC and Russia, the world lockdown situation was loosened and demand from China increased sharply.

If you’re looking to sell your property, your goal would be to get someone to sign on the dotted line as quickly as possible, with the least effort on your part and for the maximum amount you can get! Sounds easy? Well, as any property seller can tell you, it isn’t quite as simple as it sounds. The real estate market is very competitive, and if you are looking to create an excellent property listing that gets noticed by potential buyers, then you must explore the possibility of adding a 3D Floor Plan to your listing.To get more news about design rendering services, you can visit https://www.3drenderingltd.com official website.

A 3D floor plan is a house floor plan that is drawn out to scale and rendered in 3D. It depicts the rooms and spaces with furniture and furnishings; even indicating colors, textures, and finishes. It adds significant value to your listing as it shows your property in the best possible light – not as it is at present, but as how it could potentially be. Customers can visualize the property as they would like to see it, with a well-designed interior and furnishings that make it look better than its current appearance. Pictures grab the attention of viewers far more than descriptions do. With a beautifully Rendered 3D House Plan in your real estate listing, genuine buyers are drawn to your page and stay engaged for longer durations, increasing the chances of them putting your property in their short list.

A survey in 2013 by Rightmove Group Ltd suggested that floor plans are the best form of property presentation, and over a third of buyers felt that they were not likely to even look at a property that was without a floor plan. Photographs do not give a view of the entire property, but only show it in parts. It is difficult to get an overall idea of how the spaces are related to each other. A 3D plan, however, gives a clear visualization of the property so that the customer can get a mental image of the layout. Your listing becomes more memorable and can remember the design can put your property ahead of others in the same area. They can see where each room is concerning other rooms and understand the flow of the property in a much better way.

They will be able to understand the position of various rooms, doors and windows, terraces and balconies, and the garden and landscaping features. 3D House Plans are one of the proven marketing methods that can help to generate interest in your property listing, as well as give potential buyers the information they require to make their buying decisions. Detailed, high res floor plans are proven to increase the selling potential of any property and make it very easy to attract buyers to your listing. You can add the project to your brochures and flyers or even put it up on a signboard at various prime spots in town so that local prospects and people who are just driving past are aware that this property is for sale.

Chance for USD/GBP/AUD Upside as JPY Strength Limited

Japanese

firms slashed spending on plant and equipment by the most in a decade in

the second quarter, the government said on Tuesday. As a result, the

strength of the Yen was limited while the USD/JPY staged a flat

performance and consolidated around 105.70.To get more news about WikiFX, you can visit wikifx official website.

“Abenomics” is much more likely to see an end ahead of the news that

Abe suddenly resigned his post, which put a premium on the Yen at once

but later revealed to be unrealistic for markets. As the core of

Abenomics, the Yens depreciation pushes domestic prices up and stimulate

the production of companies.

However, Japan's second-quarter

Capex falls most in decade, as reported on Tuesday. In addition, the

strength of JPY will be limited considering other challenges ahead of

Japan such as shrinking workforces and the indefinite postponement of

Olympic Games.

In terms of USD/JPY, the rate is expected to see a further growth

once finding the stability above the level of 104.00 in view of the

strong support ever achieved around the level.

In terms of

EUR/JPY, the rate is now stay in the ascending channel but may hit the

resistance zone of 129.0-130.0 in future tradings if the support is

continuously gained at the lower band of 125.0.

The exchange rate

of AUD/JPY shows a more complex picture. Its short-term uptrend is

expected to suffer a setback as it is currently approaching the

resistance level of 78.60. While in the medium term, gains will be

extended in future tradings if it stays constructive below the 76.60

level.

All the above is provided by WikiFX, a platform

world-renowned for foreign exchange information. For details, please

download the WikiFX App: bit.ly/WIKIFX

A Visit to Forex Broker BP Prime in London

An investor lately

asked WikiFX to verify the regulatory information and business

conditions of the British broker BP Prime. In response to the trader,

WikiFX decided to visit the broker BP Prime in London.To get more news

about WikiFX, you can visit wikifx official website.

Broker introduction

BP Prime was founded in 2013. Headquartered in London, it has offices

in Italy and China with clients across Europe, Asia and South America,

providing contracts for difference of forex, commodities and crypto

currencies.

Great Eastern Street, where is only 20 minutes away from

the central London, has become commercialized to a great extent. Along

the way, it was found that the entire street has bristled with

high-grade office buildings. The investigator arrived at the building

numbered 62 under the help of navigation. Does BP Prime really work

here?

Entering the building, the investigator noticed that all the

entrance, reception and floors have been refurbished. The building was

accessible only by swiping its card and there were security guards

around. With advance reservation, the investigator was soon received by

the staff of BP Prime.

After getting into its office, the investigator observed that many

employees were orderly working on computers, with various documents

neatly stacked next to them. The overall environment was clean and

comfortable as the office was also equipped with a rest area and a

tearoom.

This visit confirms that the broker BP Prime is a real

one and its business address is in line with that on the regulatory

information. On the WikiFX APP, BP Prime has been rated 6.86. It is

currently under valid supervision with the Straight-Through-Processing

(STP) license of the FCA.

So far, as a popular APP among investors,

WikiFX has included profiles of more than 20,000 forex brokers around

the world while integrating forum, exposure, query, news feed and other

functions.

Relationship Between Abe and Japanese Yen

Shinzo Abe, the

longest-serving Japanese Prime Minister in history, has suddenly

resigned on August 28, citing health reasons. He will remain in his post

until a successor is chosen. Mr Abe said he would still participate in

the parliamentary vote and would not completely withdraw from

politics.To get more news about WikiFX, you can visit wikifx official website.

On September 26, 2012, Shinzo Abe was elected as the president of the

Liberal Democratic Party and won the general election later on December

26 in the year. After he became the president, the Japanese yen shrank

from the peak of 77.13, while after he became the Prime Minister, the

country‘s currency kept slipping till June, 2015 and bottomed at 125.86.

The reason is the well-known 'Abenomics', which aimed to stimulate

Japan’s exports and prevent the worsening deflation by exerting a big

depreciation in the value of the currency.

Japan‘s economy once recovered because of the Abenomics, and

investors even regained confidence amid the successful Olympic bid.

However, no one has ever expected that the outbreak of COVID-19 would

completely destroyed the Abenomics and made Abe drained and resign from

his post. After Abe announced his resignation, forex traders bought the

yen aggressively as no one could anticipated who’s his successor and

whether the following policy would be in line with Abes.

On the

other hand, Japan‘s stock markets went into a tailspin on the news of

August 28. With the unwinding of carry trade and the rising risk

aversion, the yen appeared to be strong and popular again. Under the

Japan’s uncertain political situation coupled with the continued

weakness of the U.S. dollar, the yen has the opportunity to maintain its

strength in the short term and challenge the two major resistance

levels of 104.19 and 101.48.

The New Sky Model has a better overall tint to the lighting in the

daytime and supports the sun being below the horizon for dawn/twilight

effects.To get more news about design rendering services, you can visit https://www.madpainter.net official website.

New Lens Effects give you vastly more control over bloom & glare.

78 new materials in the Corona Material Library, including new Flooring, Carpet and Ceramic Tiles categories.

Avoid texture repetitions with updates to the UvwRandomizer.

New Adaptive Environment Sampler removes the need for Portals, saving

you the time (and pain!) of setting those up while giving more accurate

results Support for foam in Phoenix FD

And more!

Chaos Czech (previously Render Legion) are the creators of Corona

Renderer, a high-performance photorealistic rendering engine. Chaos

Czech is a leader in architectural visualization software, where it

offers a simple, yet powerful approach for professional artists. Chaos

Czech continues to bring this approach to its development of new tools

and technologies for architectural visualization, VFX and broadcast.

Chaos Czech, a Chaos Group company, are headquartered in Prague.

About Chaos Group

Chaos Group is a worldwide leader in computer graphics technology,

helping artists and designers create photorealistic imagery and

animation for architecture, design, and visual effects. Chaos Group’s

award-winning physically-based rendering and simulation software is used

daily by top design studios, architectural firms, advertising agencies,

and visual effects companies around the globe. Today, the company’s

research and development in ray-traced rendering, cloud computing and

real-time ray tracing is shaping the future of creative storytelling and

digital design. Founded in 1997, Chaos Group is privately owned with

offices in Sofia, Los Angeles, Prague, Seoul, and Tokyo.

Tokeninsight published its “2020 Q2 Cryptocurrency Mining Industry Report” and the study shows a lot has happened in the bitcoin mining industry during the first half of 2020.To get more news about china industry research, you can visit acem.sjtu.edu.cn official website.

The new research paper discusses a number of topics that affected the bitcoin mining industry this year and the countries that are welcoming these operations. For instance, Tokeninsight highlights that the Uzbekistan government established a “national mining pool” in January.After that announcement, Quebec’s Hydropower Agency of Canada allowed bitcoin miners to obtain 300MW of electricity.

In February the Ukraine government said bitcoin mining “does not require government supervision and intervention.” The following month, Missoula County, Montana, created new regulations for bitcoin miners.In May, The Acting Minister of Energy of Ukraine told the public bitcoin miners might be able to draw nuclear energy. In April, the local government officials in Sichuan approved the “Hydropower Consumption Demonstration Enterprises.”

News.Bitcoin.com recently reported on the second-batch of consumption enterprises approved in Sichuan. In June, the Parliament of Kyrgyzstan said it plans to “tax and supervise digital asset miners.”Tokeninsight said that China has been the hardest hit in 2020 as the country has seen a significant impact from a variety of reasons.

The Tokeninsight researchers mentioned that Covid-19 caused mining rig shipment delays, the bitcoin halving cut revenue in half for Chinese miners, internal disputes from mining machine manufacturers like Canaan and Bitmain, and the report also mentions mining policy changes in Sichuan.“In terms of the mining machine manufacturing sector, new players are eager to enter the field, and the old overlords are also trying their best to update the technology to manufacture leading products in the market,” the paper notes. “In the first half of 2020, new generation mining machines including Bitmain’s S19 and S19 Pro, WhatsMiner M30 series, and Canaan’s A1146 Pro and A1166 Pro have been launched one after another.”

Making China’s Industries Smarter, Faster

The greatest impact on the global value chain was felt in Mainland China, where nearly 30 percent of global manufacturing output originates. This sent China’s economy into a nose dive, resulting in a record contraction in output of 34 percent in the first quarter of 2020, according to World Bank figures.To get more news about chinese industry and management practice, you can visit acem.sjtu.edu.cn official website.

While second quarter growth of 3.2 percent signals a rebound for China, manufacturing enterprises are aware that a return to “business as usual” is not an option. They need to address issues that will make them vulnerable to the next potential supply chain disruption.

If the benefits of digitalization were not clear to c-level executives before the crisis, they should be by now.

Digitalization is widely viewed as one of the keys to a sustainable recovery from the pandemic. Studies show that companies that move early and decisively to digitalize their operations during challenging times can turn adversity into advantage. Boston Consulting Group found that 14 percent of companies were able to emerge stronger from the four most recent global economic downturns, increasing both their sales and profit margins

Staying power is also key. Research by management consultant McKinsey found that companies which remained steadfast and committed to their long-term growth strategy during a downturn were able to accelerate faster coming out of it.

Some markets are benefitting from government stimulus packages that support investment in new technologies. In China, a government infrastructure package passed in March totaling $US4.8 trillion is aimed at softening the blow of current and future disruptions. It encourages investments in new data centers, artificial intelligence (AI), smart manufacturing, and 5G networks. The expectation is also that by rejuvenating legacy systems, China’s manufacturing will be able to reverse the productivity decline it has experienced since the global financial crisis of 2008.

The main applications for AI in manufacturing include value chain redundancy, remote operations, process automation, industrial robotics, predictive maintenance and machinery inspection, and autonomous materials movement. Machine learning now makes up 40 percent of all patents in the AI realm.Companies that can scale up their AI use cases during the crisis will be better able to navigate uncertain supply and demand, adjust to disruptions in operations and supply chains, allocate their workforces, and adapt to sharp changes in consumer confidence and priorities, according to analysts from Boston Consulting Group.

There is no shortage of automation experts touting the benefits of manufacturers investing in AI; investments in this technology are expected to reach $18.8 billion by 2027 (see below for more analyst predictions).

Sam Li, global senior vice president and general manager of SAP China, is convinced that digitalization will drive China’s economy out of its current trough, and that AI shows the most promise in making companies resilient.

“Just as digitalization has enabled China’s consumers to access life-essential services and stem the deadly chain of infection, digitalization in the business-to-business sector to create intelligent and integrated enterprises will be the engine for economic recovery,” Li said last month at the 2020 World Artificial Intelligence Online Conference (WAIC) in Shanghai.

He sees huge potential for AI in China’s manufacturing industries, and believes SAP is set up to become a main driver for AI in this sector: “As a global technology company with both business and R&D headquarters in Shanghai, SAP will help build a world-leading AI co-innovation and technology center in Shanghai and actively promote the integrated development of AI and industry in China.”