qocsuing's blog

Multibank Group Review 2023

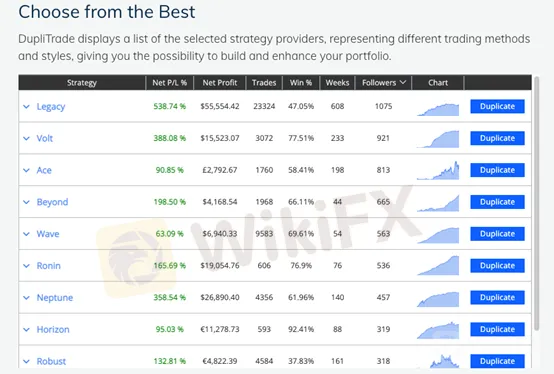

I like the choice of trading instruments at MultiBank Group, ideal for all types of traders. It offers MAM/PAMM managers the necessary tools to provide effective asset management. Social traders also have access to the broadest market exposure, granting signal providers the diversity they need to stand out from the crowd, an invaluable asset.To get more news about multibank group review, you can visit wikifx.com official website.

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. MultiBank Group presents clients with six well-regulated entities.

MultiBank Group notes eleven regulators on five continents but only lists six on its website. One additional one, in the Cayman Islands, is dormant. The overall regulatory environment is superb, and MultiBank Group maintains a secure and trustworthy trading environment.

I also like the transparency concerning the paid-up capital at MultiBank Group, which stands at $322 million. Traders get negative balance protection, which I find paramount for leveraged trading, and all client deposits remain segregated from corporate funds.

MultiBank Group offers commission-free Forex mark-ups as low as 0.8 pips or $8.00 per round lot in the Pro account, but the Standard one lists them at 1.5 pips or $15.00. The former is within the upper range of competitive trading costs, but the latter is expensive. The best offer is available in the commission-based ECN account, where traders enjoy raw spreads of 0 pips for a commission of $3.00 per round trip. The cost also applies to commodities, but index and equity CFD trading are commission-free.

One of the most widely ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

I like the low swap rates at MultiBank Group, and together with other trading costs, this broker offers traders one of the lowest overall trading costs.

MultiBank Group levies a $60 monthly inactive fee after three months, which active traders will never face. I find it a bit too much and too early compared to the industry average, but it should not be a deal breaker as almost any trader is going to make at least one trade in three months.

Traders at MultiBank Group get maximum leverage of 1:500 together with negative balance protection, a necessity for leveraged traders. Since MultiBank Group operates numerous subsidiaries in various regulatory environments, maximum leverage will differ. For active traders, I highly recommend flexible trading terms.

MultiBank Group offers its Standard account for a minimum deposit of only $50. Pro is available from $1,000, a high demand, but it cuts trading fees by almost 50%. The best trading conditions exist in the ECN option, but traders must commit $5,000, which may be high for some.

Other than trading costs, the rest of the trading conditions are identical. Maximum leverage is 1:500, multilingual customer support is available 24/7, and MultiBank Group offers MAM/PAMM accounts plus its proprietary copy trading platform. There are no restrictions on EAs, but MultiBank Group does not allow scalping strategies.

MultiBank Group Demo Account

There is a free offering of MT4/MT5 demo accounts for all three account types, with no time limit listed. The demo account is ideal for testing trading strategies and algorithmic trading solutions/EAs. The flexibility of the MT4/MT5 demo account option can create trading conditions as close as possible to live accounts, but no demo can substitute the experience and emotions of live trading.

FXTM vs. XM

In today’s broker comparison, FTXM squares off against XM. The former is owned by Mauritius-based Exinity Group and the latter by Cypriot-based Trading Point Holdings LTD. Both brokers have regulatory oversight in multiple jurisdictions. This comparison will focus on the most competitive jurisdiction for each broker, specifically and respectively, Mauritius, and Belize. Since 2011, FXTM has served over 3,000,000 clients from 180 countries, with a distinct leadership position in emerging markets. Since 2009, XM has been home to more than 3,500,000 traders from 196 countries, and its management team has visited over 120 cities in an attempt to better connect with clients. Both are dependent and trustworthy brokers with excellent management teams and market share.To get more news about xm vs fxtm, you can visit wikifx.com official website.

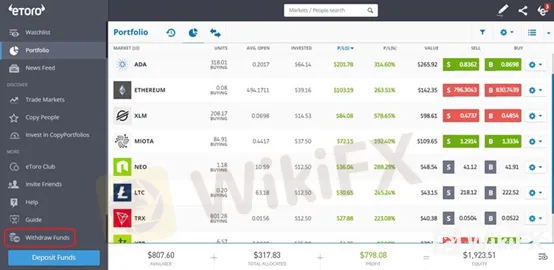

The full suite of the MT4 and MT5 trading platforms is available, consisting of a desktop client, webtrader, or mobile version. FXTM also developed a mobile-only proprietary trading platform labeled FXTM Trader. Six MT4 plugins enhance the trading platform, but this broker does not grant more prominent third-party add-ons. Automated traders have access to free VPS hosting to traders that fulfill meet specific criteria. Manual traders may use FXTM Pivot Points Strategy, which assists in market analysis. FXTM Invest supports social trading.

A well-thought-through educational section which consists of videos, articles, eBooks, webinars, and seminars offers new traders an excellent starting point into their Forex trading career. It is a genuine approach to assist clients in becoming better traders and helps to set FXTM apart from many of its competitors. In-house research consists of brief written content and market commentary videos, which adds value to this broker. High-frequency traders will benefit from the FXTM Loyalty program, which is a withdrawable cashback program.

Traders may choose between the MT4 and MT5 trading platforms. The advertised XM Web Trader appears to be the MT4/MT5 web versions, as this broker does not introduce another platform. Subscribers to the VIP Education Package will receive eight custom indicators to upgrade MT4/MT5. A free VPS service supports automated traders, while XM deploys numerous bonus programs to encourage more deposits and trading volume via a points-based system, redeemable for credit bonus awards.

New traders have access to a live education room, which adds tremendous value. An extensive video library presents high-quality content, enhancing educational capabilities at XM. This broker additionally hosts Forex webinars and seminars, and is a very active member of the global community. An in-house web TV service exists, and traders receive free access to market research and trading ideas, sourced in-house and via third-parties. The overall product and services portfolio at XM remains competitive.

FXTM offers 63 currency pairs together with eight commodities and four cryptocurrencies. The 175 US and European equity CFDs, eleven index CFDs, and 347 US stocks for direct share dealing complete this broker's asset list. XM has a slightly smaller Forex selection with 57 currency pairs, but a broader choice in commodities with fifteen. Unfortunately, no cryptocurrencies are available. XM does provide equity traders with 1,140 CFDs and 100 stocks plus eighteen index CFDs and eight futures contracts. While both brokers offer an outstanding choice for most retail trades, the overall asset selection at XM is significantly superior to FXTM.

FXTM carries commission-free minimum spreads of 1.5 pips in the Cent and ECN Zero Account, lowered to 1.3 pips in the Standard account. Portfolios above $25,000 (or a currency equivalent) qualify for 0.0 pips in a Pro account. The commission-based ECN MT4 account offers a competitive starting spread of 0.1 pips for a commission between $4 and $20. Commission-free CFD trading is available in an unleveraged account. XM deploys a more competitive cost structure, where the Micro and Standard account options commence with 1.0 pips, and the XM Ultra-Low account from 0.6 pips. All three are commission-free, but unleveraged share trading is commission-based.

Both brokers charge swap rates on overnight leveraged positions and forward to its traders corporate actions which impact equity and index positions, such as dividends, splits, and mergers. Deposit and withdrawal fees do not apply, but third-party charges exist, depending on the payment processor. FXTM levies a monthly inactivity fee of $5 (or currency equivalent), which is the same at XM, except for a one-time $15 charge. XM maintains a more competitive trading environment for all traders, while FXTM rewards high-volume clients. Both brokers have a loyalty program, which reduces the total trading costs.

What are ‘pips’ in forex trading?

In forex trading, the smallest price change is the last decimal point. Given that most major currency pairs, such as those involving USD, EUR and GBP, are priced to four decimal places, a pip in this scenario is a price movement of 0.0001. For example, if GBP/USD moved from 1.4000 to 1.4001, it has moved by one pip. Comparatively, currency pairs using the Japanese yen (JPY) are only quoted to two decimal places. In this case, a pip is a price movement of 0.01. For instance, if GBP/JPY moved from 150.00 to 150.05, it has moved by five pips.To get more news about pips in forex trading, you can visit wikifx.com official website.

You can trade on the forex market through financial instruments such as spread betting and trading CFDs (contracts for difference). This involves opening positions based on the prediction that one currency will strengthen against another. For example, for every pip or point that a currency’s value varies, this will result in profits or losses for the trader, depending on the direction that the market heads.

How to use pips in forex trading

If a trader enters a long position on GBP/USD at 1.5000 and it moves to 1.5040, the price has moved 40 pips in the trader’s favour, potentially leading to a profit if the trade is closed. On the other hand, if the trader goes long on GBP/USD at 1.5000 and the exchange rate falls to 1.4960, the price has moved 40 pips against the trader, potentially leading to a loss on the trade if it is closed.

Similarly, if a trader goes long on GBP/JPY at 145.00 and it moves to 145.75, the price has moved 75 pips in the trader’s favour. If the exchange rate goes against the trader, and GBP/JPY falls to 144.25, the price would have moved 75 pips against the trader.

As well as measuring price movements and profits and losses, pips are also useful for managing risk in forex trading and for calculating the appropriate amount of leverage to use. For example, a trader can use a stop-loss order to set the maximum amount he is willing to lose in terms of pips on a trade. Having a stop-loss in place will help to limit losses if the currency pair were to move in the wrong direction.

Forex position size calculator

Pips can be used for the calculation of position size. If a trader’s combined position sizes are too large and they experience a number of losses, their capital could be wiped out. Therefore, trading with an appropriate position size is essential.

There are several steps involved in calculating position size:

A trader must determine the amount of capital they are willing to risk per trade. If this is 1% per trade, they could make a minimum of 100 trades before their capital is wiped out. If the trader’s account has a balance of $5,000 and they are willing to risk 1% per trade, this equates to $50 per trade.

Traders can determine a stop-loss in pips. For example, if a trader goes long on EUR/USD at 1.3600, they could place a stop-loss at 1.3550. This stop-loss equates to 50 pips.

The last step depends on what lot size is being traded. A standard lot refers to 100,000 units of base currency and equates to $10 per pip movement. A mini lot is 10,000 units of base currency and equates to $1 per pip movement. A micro lot is 1,000 units of base currency and equates to $0.10 per pip movement.

If the trader risks 1% of his $5,000 balance per trade for a micro lot ($0.10 per pip movement), the position size would be $50 / (50 pips x $0.10) = 10. Therefore, the trader’s position size would be 10 micro lots.

Best Forex Brokers in Nigeria for 2023

Forex Trading is a popular financial instrument for investing in the markets. However, choosing the right forex broker can be a tricky task.To get more news about best forex brokers in nigeria, you can visit wikifx.com official website.

In a rapidly developing country such as Nigeria, there are so many good brokers, but there are also a lot more scam brokers operating in the market. So it is really important to only choose trusted & regulated Nigerian forex brokers and avoid the bad ones.There are various aspects that we looked into in order to assess each broker, these include the broker’s compliance with multiple Top-tier regulations, broker reviews, the amount of fees charged (spreads, commissions & even the hidden charges), leverage offered, minimum deposit, funding & withdrawal methods and time taken etc.

Our below vetted list is created especially for Nigerian traders; it will quickly allow you to compare the key features including spread, leverage, regulation & other factors that you must look for in any reputed forex broker.

Here’s our updated list of the 8 best performing forex brokers in Nigeria in terms of trading & non-trading fees, promptness of deposits & withdrawals, trade execution, support & deposit bonus (last 6 months):

FXTM’s was founded in 2011 & they are a FCA regulated forex broker, which is a Top Tier regulation, so we consider them to be a safe broker. They offer 3 account types, all of them can be funded in USD or Naira & have very low minimum deposit requirements starting from ₦10,000 with the Micro Account. This makes FXTM a very good choice for Nigerian traders.

The typical fees depends on your trading account. On average the typical spread for major like EURUSD with the Micro Account is 1.9 pips. This is higher than many other brokers. For lower spread you should choose Advantage account which has a typical spread from 0 pips for major like EURUSD, plus a commission of $4.88 which becomes lower as your trading volume increases.

Their Swap fees are moderate. For major currency pair like EURUSD, the Swap fees is 5.27 for Short & -10.42 for Long positions (as of Jan. 2023). If you have a Swap Free account, then the daily fees is -7.5 per lot for EURUSD with all their account types. This makes their overall trading fees moderate.

Apart from forex trading, FXTM also offer other instruments such as CFDs on Commodity Futures and CFDs on spot metals making them a very attractive choice for traders looking to diversify their trades. They have also recently upgraded its range of currencies & now offer 57 Major & Minor currency pairs. FXTM also has NAS100 instrument available to traders in Nigeria.

Another important factor that we look for in a broker is their promptness of support & withdrawals, and FXTM beats other brokers hands down in this area. ForexTime has local deposit & withdrawal option available in Nigeria, and you can deposit & withdraw in Naira at zero fees.

FXTM broker has local offices in Lagos & Abuja. They offer English language customer support via Phone, Live Chat & email. FXTM has 19 deposit & withdrawal options which includes many methods for Nigerian traders including Bank Transfer in NGN & Card payment. FXTM allows users to create a demo account in order to build their confidence and learn the art of trading. Plus the also offers a wide range of educational material to its clients, including trading webinars.

HotForex was established in the year 2010. They are regulated with FCA (UK), CySec & even Financial Sector Conduct Authority (South Africa), so we find them to be a trusted broker for Nigerians.

They have very low minimum deposit, as low as $5. Also, they offer extremely competitive spread of 0.3 pips for EUR/USD with Zero Account (1.3 pips with Premium, Micro Accounts), 0.8 for USD/JPY, 0.6 for GBP/USD (this may vary depending on the market fluctuations). Their typical spread for forex pairs is lower than most other brokers.

The Swap fees at HotForex is not that low for most currency pairs. For example, for a major currency pair like GBP/USD, the Swap Fees is -1.1 for Short positions & -4.9 for long positions. This is higher than many other CFD brokers like Exness. So, the overall fees would be higher for positional traders, but it is low if you are an intraday trader.

Is T4Trade a Legitimate Broker?

First things first, who are T4Trade? Simplified, they are a multi-asset brokerage based and regulated in sunny Seychelles. With over three hundred distinct products from Forex to shares, education webinars to podcasts, it may seem like a done deal with T4Trade, especially considering that its geographical placement allows the trader to operate with a higher leverage. However, before pound signs start flickering through your eyes, the brokerage itself warns that you should not jump in headfirst. I spoke to an analyst at T4Trade who disclosed that ‘When it comes to trading, it is essential to trust your broker with your money. To be able to do that, you need to make sure that your broker is regulated. The stricter the regulations, the better your funds are protected.’ A further look provided that T4Trade are regulated by the Seychelles Financial Services Authority. Client funds are of utmost importance and are segregated into accounts in top-tier banks, so any fear of bankruptcy on the part of the broker is assuaged. To get more news about is t4trade still trustworthy, you can visit wikifx.com official website.

The more cautious (and arguably more sensible traders) who are interested, but not quite ready to commit, will be happy to know that T4Trade offers a demo account. Allowing the trader to assess not only trading strategies but also T4Trade in general. As the analyst suggests ‘The best way to know whether the broker is for you or not is to open a demo or cent account.’ Yes, that is correct, there is access to a cent account, allowing the wary trader to transition with ease.

Regulation and access to no and low-risk tryouts lend credence to T4Trade’s credibility. Furthermore, you will want a more in-depth account of what they offer beyond demo accounts and flexible leverage. There is a variation of account types, including floating or fixed spreads, ranging from standard, premium to privilege, and covering the needs of different traders. This is paralleled in the assets offered alongside the accounts operating on the well-used and trusted MetaTrader 4. You can keep an eye on shares while trading precious metals simultaneously. With additional access to mobile trading on the go and their new release of the T4Trade Academy, which offers educational resources and webinars, there is not much more you could ask for from a well-rounded brokerage.

With all the above laid out on the table, it is time I return to the original question: is T4Trade a legitimate brokerage? The overarching answer is yes. Not only are you provided with access to all the tools you could need, but T4Trade also supply educational resources and customer support. Most vitally, they are financially regulated with flexible leverage. However, if you are still not sold, head over to the T4Trade website and set up a Demo Account, or talk to one of their trusted analysts, who are only happy to help get you started on your trading journey.

BEST FOREX BROKERS FOR ALGORITHMIC TRADING

Algorithmic trading (algo trading for short) uses computer programs to execute trades automatically based on predetermined criteria. These programs enter and exit positions on traders' behalf when market conditions meet given parameters. Algo trading empowers traders to seize market opportunities faster and more efficiently.To get more news about best forex brokers for algo, you can visit wikifx.com official website.

With so many brokers to choose from, it can be time-consuming to find the right algo-focused broker.

This article introduces you to the top brokers for algorithmic trading and helps you choose the one that best fits your specific needs.

FOREX.com is a popular brokerage for algorithmic traders, offering advanced platforms with MT4/MT5 integration, which makes it ideal for automating trades. Traders can leverage a variety of custom indicators and expert advisors (EAs) to create and backtest their strategies. The broker's education resources are comprehensive, and customer support is available 24/7.

AvaTrade offers multiple trading platforms, including the ubiquitous MT4/MT5 platforms, which are renowned for their algo trading capabilities. Its proprietary trading platform, AvaTradeGo, also spots powerful algo trading features. AvaTrade's easy-to-use platforms make it the ideal starting point for new traders.

3. Pepperstone

Pepperstone is an online forex and contract for difference (CFD) broker that offers a range of trading platforms, including MT4/MT5 and cTrader platforms. The broker supports expert EAs and advanced charting and has some of the lowest latency in the industry, which is vital for traders employing high-frequency trading strategies.

4. Interactive Brokers

Interactive Brokers offers API options for advanced traders to automate their trading. These options include the REST API, IBKR API and FIX API. Professional clients with an IBKR Pro account can access additional automated trading services. Users can build trading robots and algorithms using various programming languages on the proprietary platform.

5. Eightcap

Eightcap is a highly-rated Australian forex and CFD broker that offers 45 forex pairs and about a dozen CFDs. It supports MT4/MT5 platforms and offers integration with specialized tools for algorithmic trading and advanced charting. Eightcap offers integration with third-party plugins like Capitalise.ai and TradingView, making it easier for traders to use advanced algorithmic trading strategies.

What is Algorithmic Trading in Forex?

Algorithmic trading is a way of using computers to execute trades automatically based on certain rules or algorithms. These rules can be based on factors like technical indicators or market conditions. Algorithmic trading is often used in financial markets, like forex or stocks, to make trades faster and more accurately than humans can. It is beneficial for big trades or for taking advantage of small price changes. To do algorithmic trading, people use special software and programming languages. Professional traders and big investors mostly use it, but individual traders can also use it through online brokerages.

Trend Following

Trend following is a popular algorithmic trading strategy that involves identifying and following the direction of a market trend. The goal is to capitalize on the momentum of a market trend and ride it for as long as possible.

To implement a trend-following strategy, traders will typically use technical indicators or other tools to identify the direction of a market trend and set rules for entering and exiting trades. For example, a trend-following algorithm might be programmed to buy a security when its price breaks above a particular resistance level and to sell when the price falls below a specific support level.

Trading Range (Mean Reversion)

A trading range, or mean reversion strategy, depends on identifying and trading around the average price of a security. This strategy attempts to profit from deviations from the mean price, which is expected to return eventually. Mean reversion algorithms use technical indicators or other tools to identify the average price and set rules for entering and exiting trades based on deviations from it. These algorithms can be applied to various time frames and currency pairs in the forex market.

Arbitrage

In arbitrage algorithmic trading strategy, traders buy low and sell high in different markets, aiming to profit from price discrepancies. Forex traders apply algorithms that identify and take advantage of differences in the price of a currency pair on different exchanges or exploit interest rate differentials between currencies. While arbitrage can potentially generate risk-free profits, it is essential to note that opportunities may not always be available.

Delta-Neutral Strategy

A delta-neutral trading strategy involves creating a position that is not affected by changes in the price of an underlying security. By combining options and spot trades to create a delta-neutral position, traders can profit from changes in the underlying security's volatility. While delta-neutral trading can generate profits from changes in volatility, it can also be complex and involve using leverage, which can increase the risk of losses.

Index Fund Rebalancing

Index fund rebalancing is a strategy where traders can profit by capitalizing on index funds periodically rebalancing. In rebalancing, index funds adjust the composition of securities in a portfolio to maintain a desired asset allocation and manage risk and return. Algorithms execute this strategy speedily and at the best possible prices.

5 Lighting Trends to Watch in 2022

LED strip lights are always a useful solution, but this year, LED strip lights can also help you keep up with some of the most exciting lighting trends of the year. HitLights presents 5 lighting trends you can bring to your home or office in 2022 using LED strip lights. To get more news about led neon light strip manufacturer, you can visit htj-led.com official website.

There is no competition for LED strip lights when it comes to innovation—there has been no greater innovation to lighting in 100 years than the LED, most people know this as a fact. But oftentimes LED fans have to sit by idly during discussions of trendy lighting or “in” design lighting. LED lighting is usually thought of as a functional product, not fashion. But this year, some of the best lighting trends are ready made for LED strip lights to help you stay current with the latest and greatest in lighting. Here are five of the hottest trends happening in lighting in 2022 and how LED strip lights can help you bring the trends into your space.

Layering Lights

Layering lights is an effect created with multiple light sources throughout a room or area. The opposite of focal point lighting (like a big, dramatic chandelier for example) layering lights uses a variety of light sources, in a variety of applications, including mixing incandescent lights and LED lights. The result is a softer, more diffuse light in a room. Think of it as creating a tone rather than getting maximum lighting from one place.

LED strip lights can help you achieve this look with applications like LED strip lights in book cases (creating an illuminated cabinet look) or strip lights behind wall hangings or art (to give additional interest or to create backlighting. Use our HitLights Luma20 WAVE LED strip lights, made to follow curves.)

Even LED strip lights mounted with crown molding can be used in layering lights—not serving as the main light source, but being lit with other lights, creating the layers. Have fun experimenting with what moods can be struck by layering lights.

Dress Up Your WFH Oasis

Welcome to the hybrid work life. Your home office space is just important now as it has been and that’s probably going to be true for the time being. Consider this: how many video meetings do you have just this week? No more putting it off, your time to decorate your work from home hub is now. The bare blank wall look isn’t going to cut it anymore. This trend is all about styling your space to reflect you and be a part of your professional look.

If you’re thinking to yourself, what does that mean? Seriously, “professional look”? Isn’t that a little over the top? We hate to say it, but in the same way people dress in clothes that are designed to convey your professionalism, what people see on your video meetings reflects your professionalism, too. Do you want potential customers or clients or other important personnel thinking—even subconsciously—"we’ve had a couple years of doing these meetings and that’s the best they could do?”

In US business culture, generally we show our faces to each other in meetings, so don’t think you can hide behind a turned off video cam. The good news is a few small changes can have a big impact on your WFH look and let you get in on this trend that is sure to improve your overall presentation.

Purchase a simple and inexpensive ring light to illuminate your face for video meetings (finally! We know you’ve been putting it off!) Install LED strip lights (like HitLights 16.4ft RGB Light Strip Kit, Color Changing LED Strip Lights with Remote and 12V UL Adapter) along the baseboard of your home office. Set the colors to match your company logo or pick another complementary color scheme. Colored light provides dynamism that a plain wall can’t achieve.

For your own enjoyment, install LED strip lights on the backs of your monitors (you can use a convenient kit like our HitLights Eclipse LED strip light kit; pre-cut installation is complete in minutes) and change up the color as needed to get you through your work day. Like work from home, this trend has staying power. Start small and bring this trend into your home office today.

Solar Power at Albany Pumps

The Albany Pumps factory is a big consumer of electricity as our factory is filled with CNC machines, all busy making our gear, screw and lobe pumps. Albany has now made a big investment in solar panels which can be seen on the roofs of the Albany buildings at Lydney. The panels started working on the 8th of May 2022 and two months later, they have already saved 7.5 tons of carbon dioxide, equivalent to the planting of almost 350 trees. In good conditions, the panels will supply more than half the electricity needs of the factory. Overall, around 2/3rds of the electricity produced is used by Albany and 1/3rd is exported back to the grid. With current electricity prices, there is no doubt that this has been a good move for Albany.To get more news about Screw pump rotor, you can visit hw-screwpump.com official website.

The panels have a control system mounted inside the factory. There’s a web based system that gives real time data on electricity generation and use and also gives comprehensive data on the electricity saved by the system since installation.

The system was installed by locally based Forest Eco Systems. Have a look at their website: They’re doing some amazing work installing not just solar panels but also heat pumps and other systems to all sorts of buildings. They’ve installed more than 2000 solar panels and close to 200 heat pumps so we know that they’re the right team to be working with.

Albany have also made a big investment in new windows for the factory and offices and these are helping to reduce energy consumption and also make the buildings lighter and more pleasant to work in.

Georgia ministry helps supply bulletproof vests and helmets to volunteers

Our organization started with work in Ukraine in 1993,” said Rob Browne President and CEO of YouthReach International.To get more news about bulletproof tactical helmet, you can visit bulletproofboxs.com official website.

YouthReach International works with and supports at-risk youth, all over the world. When the war started in Ukraine, the teams with YouthReach, continued on with their mission, but in a different way.

”It has been quite strange to find ourselves in the middle of a war. It is not a war that directly involves our country,” said Browne.

There is a team of Ukrainian YouthReach volunteers who are living part-time in a Ukrainian forest for safety. They go to war-torn areas and make sure people have water, food and support. Their team is growing.

”In the coming weeks, we are going to need more of the bulletproof helmets and vests,” said Browne.

Georgians helped the organization outfit these men and more than a dozen others with bulletproof vests and helmets. More protective gear will be needed.

”We only outfit humanitarian workers,” said Browne.

Two weeks into the war, YouthReach helped coordinate an evacuation of kids in an orphanage, they have worked with for years. The building was too close to a war zone. The children have been taken to a neighboring country. They are safe and well fed, but they are having to start new lives; learn to speak a new language, and start a new school.

The older ones especially...they are starting to see their new reality. It is going to be a long time, if ever, that they get to go home,” said Browne.

While war changes most things, it hasn’t changed a promise YouthReach made to Ukrainian families several years ago.

”We were with you in eastern Ukraine before all of this started. We were with you on your journey out of the country. I am with you where you are,” said Browne.

The Benefits of Progressive Cavity Pumps in your Dispensing Process

Progressive cavity pumps are ideal solutions for applications requiring a high level of dosing accuracy while minimizing shear on dispensed materials. By nature, progressive cavity pumps

operate in accordance with a positive displacement principle. Material flows through the valve as it progresses through fixed cavities created as a helical rotor turns. Since each cavity is

fixed, slight variations in material characteristics will not impact the volumetric displacement, making progressive cavity pumps highly accurate options for precise applications.To get more news about progressive cavity pump rotor, you can visit brysonpump.com official website.

As the rotor spins, it self-seals against a molded seal called a stator. The fact that the rotor seals is critical as it allows the pump to be widely used with low viscosity fluids without dripping. The rotor’s rate of rotation is controlled via a servo motor. The rate of rotation directly impacts the pump’s output creating a linear relationship between motor RPM and flow rate. For example, if you were to double the rotor’s RPM, you would in turn the double the flow rate of the pump. This relationship makes programming the pump or customizing your dispense volume very easy to accomplish.

One of the greatest advantages of progressive cavity pumps is that the dispensing process is continuous and pulse-free. Unlike piston pumps, a progressive cavity process does not need to recharge a metering chamber permitting limitless shot sizes. Further, the rotor-stator design principle and low inlet pressure (under 85 psi) result in very little shear on the chemistry. Low shear means minimal wear on the pump itself and the ability to process lightly filled or abrasive chemistries without damaging the material. The rotor and stator can also be made of various materials. When processing abrasive fluids, it is common to utilize a carbide rotor to assure longer pump life.

Progressive cavity pumps can be utilized in single or dual-component applications. Their ability to accurately dose small quantities of material makes them ideal choices for difficult-to-process 2K applications with wide mix ratios. Again, with equivalent displacement pumps in operation, you can easily program and tweak a mix ratio by altering the rotor RPM speed. At a 1:1 ratio, both pumps would run at the same motor speed. At a 2:1 ratio, component A’s pump would run twice as fast as pump B.

Common applications for progressive cavity pumps are precision bead dispensing, encapsulation, and conductive greases or thermal interface materials. If progressive cavity pumps have a downside, it is in their limited flow rates. Having a full line of pumps that feature a wide range of rotor displacements is a must for flexibility. Even though progressive cavity pumps are a continuous flow process, a pump with a mismatched flow rate can lead to a significantly longer lead time than is necessary. Consult your dispensing professional to assure the progressive cavity pump selected for your application is optimized across all necessary dispensing processes.