wisepowder's blog

Pods or Mods?

We

often find people asking us the question, “what would be a better

system to use; a refillable tank and mod system or a pod device that

requires replacement cartridges?” There are some pros and cons to using

each device, but we believe it is better to use a Mod system instead.

Gather ‘round while we go over the details.To get more news about Pod Kits, you can visit univapo official website.

Mods

have more power! – Mod systems are equipped with far more technology

than pod systems, so they can offer higher wattage, better firing power,

more temperature control; the list goes on and on. This means that Mods

will give you more pull, more flavor, and larger vape clouds than a Pod

could.

Better

visuals, more grip! – Many Mods are becoming sensitive to the user,

meaning that companies like Segelei and Smok are making comfort and

design one of their main focuses for the new devices that they develop.

Pods are usually more difficult to handle simply because they’re much

thinner and smaller than Mods, which does make them easier to carry

around in pockets or pouches, but at the same time makes it an easier

device to drop or lose.

Mods

are less expensive! – In the long run, vapers that use pod systems will

spend way much more money purchasing replacement cartridges, which

average about $15 for a typical pack of three 2mL pods, rather than how

much they would spend on a bottle of e-juice to use in a Mod system.

Pachamama e juice, for example, is an e-juice brand that costs an

impressive $18 for a 60mL bottle and offers a wide variety of flavors,

compared to paying almost the same amount for only 6mL and not having as

many flavor options with a pod.

Mods

can be reconstructed! – This feature is more for the advanced and

seasoned vapers, but Mods have RDA’s, RTA’s, and RDTA’s that can be

customized. Coils can be removed, added, and tanks can be switched out

to suit the user and their individual preferences.

Pods

are easier to use! – Pod systems are easier, however, to grab and go

for a fast-paced day and they offer salt e-liquid for all of their

replacement cartridges, which is easier than having to get a specific

tank for your mod and making the modifications for salts.

once key to Abenomics, suffer as pandemic closes businesses

On a

recent Saturday in Tokyo's Shinjuku district more than 100 people, many

of them elderly men, stood close together in a long queue waiting for

food hand-outs.To get more news about WikiFX, you can visit wikifx official website.

One of them, Tomoaki Kobayashi, said he was fearing the day he would

lose his home as his pension alone was not enough to pay the rent. Still

spry, the 72-year-old said he lost his job cleaning pachinko parlours

after many of the gambling halls were shut in a state of emergency

imposed because of the coronavirus.

“This is the final month. I

can't pay any longer,” Kobayashi said of his rent, clutching a small

sack of groceries - snacks, instant curry and hashed-beef rice that

would feed him for the next few days. He said he had paid pension

premiums for just 15 years, unlike the 33 years for most pensioners,

meaning he is eligible for only 54,000 yen ($500) every two months.

Elderly Japanese became an increasingly important part of the labour

pool after Prime Minister Shinzo Abe launched his “Abenomics” policies

in 2012 to revive the world's third-largest economy.

In a country

with the world's oldest population and lingering unease about

immigration, elderly workers fill roles as shop clerks, cleaners and

taxi drivers. For some, the work provides an additional boost to a

pension and considerable savings. But for lower-income workers like

Kobayashi, part-time jobs are a lifeline.

Now, the coronavirus has

shuttered shops and offices and left some of the most vulnerable

members of the labour force untethered, even as they are more at risk

from the disease than other age groups.

“Elderly who have to work

because of low pensions are facing tough conditions,” said Takanori

Fujita, who co-heads a network of non-profit workers, lawyers and

academics tackling social issues caused by the outbreak.

“We're holding consultations (with elderly) no longer able to pay their rent or electricity bills,” he said.

About 13% of the labour force are aged 65 or older, up from 9% when

Abe returned to power in 2012, according to government data. More than

three-quarters of elderly workers are non-regular employees, part-timers

and contract workers who are the first to lose their jobs when business

is under pressure.

“I think it's hard for them to start working

again if they lose their job once,” said Taro Saito, an executive

research fellow at NLI Research Institute.

The jobless rate hit a

one-year high of 2.5% in March, a rate that is the envy of many nations.

Still, an increase would further dampen demand and more elderly out of

work could put greater strain on social services as Japan braces for its

worst postwar economic slump.

“Japan isn't a country like the

United States where the unemployment rate rises and falls greatly,” said

Saito. “The negative impact is big even if it rises by just 1%.”

Nearly a fifth of elderly Japanese live in relative poverty, meaning

their income is less than half of the national median household income.

The average for over 65 across the Organisation for Economic Cooperation

and Development is just shy of 14%.

Single-person households that

consisted of unemployed people aged 60 and over in 2018 had on average

about 123,000 yen in real income per month, coming mostly from pensions.

Compared to their expenses, those households had a shortfall of about

38,000 yen a month, government data shows.

Tsuyoshi Gonda, 60,

applied for unemployment benefits after he was laid off from his

full-time job as a hairdresser in Tokyo's Katsushika area in mid-April.

That was not long after Abe called for the state of emergency because

of the coronavirus, urging people to avoid crowds and prompting many

businesses to shut.

“The number of customers dropped to zero a day

after the emergency was in place,” Gonda said. “It was a shop where

people decided to come on the day. It was very harsh.”

UK Will Cut Tariffs, France and Germany Fight Pandemic Together

As

the world's second epicenter after China, Europe, after months of hard

work, had survived the worst period of the epidemic and gradually began

to shift the focus to economic recovery. Large fluctuations are expected

in the European forex market.To get more news about WikiFX, you can visit wikifx official website.

With the alleviation of the coronavirus pandemic, the UK continues

the process of Brexit. A few days ago, the British government announced a

new post-Brexit tariff system to replace the EU's common external

tariffs. The British government stated that the new tariff system, known

as the “British Global Tariff”, will be formally implemented on January

1st, 2021. Compared with the EU's common external tariffs, the new

tariff will be simpler and cheaper. The new plan will see Britain's

tariffs reduced by 30 billion pounds after Brexit. The news shortly

propped up the pound to a new high in 4 trading days. However, the pound

is still under test. Bearish factors, such as bumpy progress of the

latest round of Brexit negotiations and the negative attitude of traders

towards the pound, continue to affect the currency.

On the other

hand, there have also been recent moves within the EU. In response to

the severe economic recession caused by the epidemic, leaders of France

and Germany supported the establishment of a European Union recovery

fund of €500 billion (US$ 543 billion), which will be supported by joint

borrowing from EU member states. Affected by this news, the euro once

rose to its highest level since May 4th and finally closed higher.

However, the plan still faces a blurry outlook as the final agreement

will require the support of all 27 member states, while Austria

immediately reaffirmed its objection to direct assistance. German

Chancellor Angela Merkel said that the current EU treaty remains

unchanged but may be changed in the future, which opens the door for

further fiscal integration, a positive factor for the euro.

While

countries began to restore their economies in the post-epidemic period,

the different situations they're facing may lead to an unbalanced

recovery pace, and there will still be greater uncertainties in forex

markets.

For more financial information and forex market updates, please visit WikiFX official website or download WikiFX App.

GBP Faces Pressure with Inflation Rate at 4-year’s Low

May

21st from WikiFX News. Britains inflation rate dropped to the lowest

since August, 2016, raising speculations that the Bank of England will

have to take further measures to boost demand.To get more news about WikiFX, you can visit wikifx official website.

In addition, Britan‘s CPI grew 0.8% year-on-year, lower than

economists’ expectations. The figure may kindle an even more heated

debate over whether the central bank should introduce negative interest

rate for the first time.

HSBC downgraded its forecast of GBP/USD

before the end of the year from the previous 1.35 to 1.2, while pointing

out the risks including Britains fiscal well-being(as the worst of G10

members) and Brexit: euro is expected to rise from 0.81 to 0.87 against

pound before the end of the year, the British government again dismissed

the possibility of extending the Brexit transitional period, while it

seems unlikely for the two sides to completely settle a free trade deal

before the end of 2020.

With Britain sinking into a severe

recession and the economy in sluggish recovery, structural factors may

further weigh on the pound.

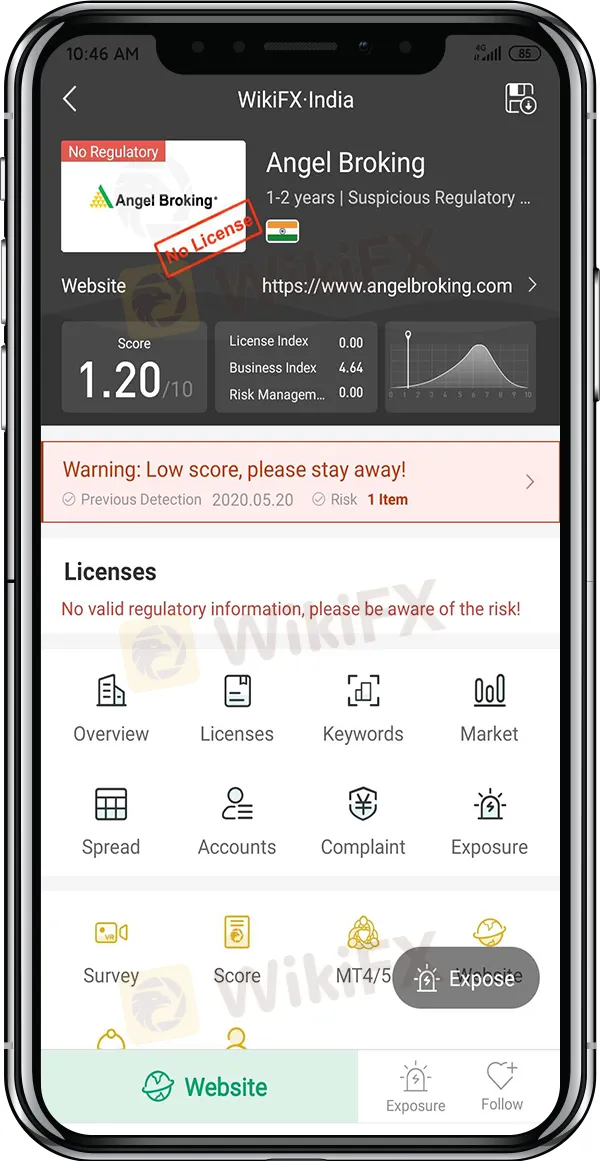

Angel Broking Charged Unjustified Trading Commissions

Investors

may be quite immune to lame marketing scripts such as“Invest US$300 and

get US$3,000 of returns in 24 hours”. But when the scam broker claims

to offer high returns for low brokerage rates, investors may not realize

its a trap.To get more news about WikiFX, you can visit wikifx official website.

Recently, an Indian investor complained against the broker Angel

Broking for unjustified deduction from his trading account, hoping to

bring the broker to justice. The complainant told WikiFX that he was

attracted to Angel Broking for its so-called zero cost brokerage.Angel

Brokings advertisement on moneycontrol, an established Indian financial

media

But not long after he made his deposits, investor received

several confirmation text messages of account deduction generated by the

broker, each time for 800 rupees.

Through observation, the investor found that every transaction from his

trading account will generate an automatic deduction of account balance

which goes to the broker. He complained that Angel Broking‘s

advertisements about “zero commission” is an outright lie as they make

unreasonable deduction of investor’s account and exploit investors

trust.

We may conclude that Angel Broking is an illegal broker

which tries to lure investors to its trap with the bait of so-called

“zero commission”. Per checking WikiFX App, Angel Broking is rated at

only 1.20 and is currently unregulated, so please stay away!

In

India‘s forex market, there are still many brokers like Angel Broking

that try to scam investors by claiming to charge attractively low

commissions. Major discount brokers in India like upstox and Zerodha are

also being heavily complained recently for withdrawal failure, trading

server lag and causing unjustified losses. Indian investors should

definitely be more aware, as many investors choose a broker solely base

on its commission, yet seldom pay attention to the broker’s compliance.

Even some brokers on the regulatory list of SEBI are not necessarily

reliable and worth-choosing. Stay tuned as WikiFX continues to present

you latest exposures of Indian forex brokers.

So far, WikiFX App

has included profiles of over 18,000 forex brokers around the world,

while integrating broker information query, exposure, news feed and

other functions, offering investors 24/7 services.

To report illegal traders, please contact WikiFX official customer service at [email protected].

You may also download WikiFX App and sign up as VIP member for more information and services.https://bit.ly/3ajawKO

Japan's economy falls into recession as virus takes its toll

Japan has fallen into recession as the financial toll of the coronavirus continues to escalate.To get more news about WikiFX, you can visit wikifx official website.

The world's third biggest economy shrank 3.4% in the first three

months of 2020 compared to a year ago, its biggest slump since 2015.

The coronavirus is wreaking havoc on the global economy with an estimated cost of up to $8.8tn (£7.1tn).

Last week, Germany slipped into recession as more major economies face the impact of sustained lockdowns.

Japan didn't go into full national lockdown but issued a state of

emergency in April severely affecting supply chains and businesses in

the trade-reliant nation.The 3.4% fall in growth domestic product (GDP)

for the first three months of 2020, follows a 6.4% decline during the

last quarter of 2019, pushing Japan into a technical recession.

More financial stimulus to come

Consumers have been hit by the dual impact of the coronavirus and a sales tax hike to 10% from 8% in October.

While Japan has lifted the state of emergency in 39 out of its 47

prefectures, the economic outlook for this current quarter is equally

gloomy.

Analysts polled by Reuters expect the country's economy to

shrink 22% during April to June, which would be its biggest decline on

record.

The Japanese government has already announced a record $1

trillion stimulus package, and the Bank of Japan expanded its stimulus

measures for the second straight month in April.

Prime minister

Shinzo Abe has pledged a second budget later this month to fund fresh

spending measures to cushion the economic blow of the pandemic.

How can Japan turn things around?

Japan faces a unique challenge as its economy has been stagnant for

decades, compared to the more buoyant economies of rivals the US and

China.

Japan also relies heavily on exporting its goods and has

little control over consumer demand in other countries which have been

severely impacted by coronavirus lockdowns. Many of its biggest brands,

like car firms Toyota and Honda, have seen sales slump across the world.

Tourism, which has long been a boost to the Japanese economy, has

also been hit hard as the pandemic keeps foreign visitors away. Japan

has had more than 16,000 confirmed coronavirus cases and around 740

deaths.

How does it compare to other major economies?

Things

look bleak for the Japanese economy in the short term, along with other

major economies around the world. But despite being the first of the

world's top three economies to officially fall into recession, the

country actually appears to be doing better, or less badly, than other

major economies.

While economists predict Japan's economy will

shrink by 22% this current quarter, they also predict that the US could

contract by more than 25%. The 3.4% decline also compares favourably to

the 4.8% the US suffered in the first three months of this year.

This was the sharpest decline for the US economy, the world's biggest, since the Great Depression of the 1930s.

China, the world's second largest economy, saw economic growth shrink

6.8% in the first three months of the year, its first quarterly

contraction since records began.

Both of those economies haven't

yet been confirmed as having fallen into a technical recession, which is

defined as two consecutive quarters of negative growth, but most

economists expect them to in the coming months.

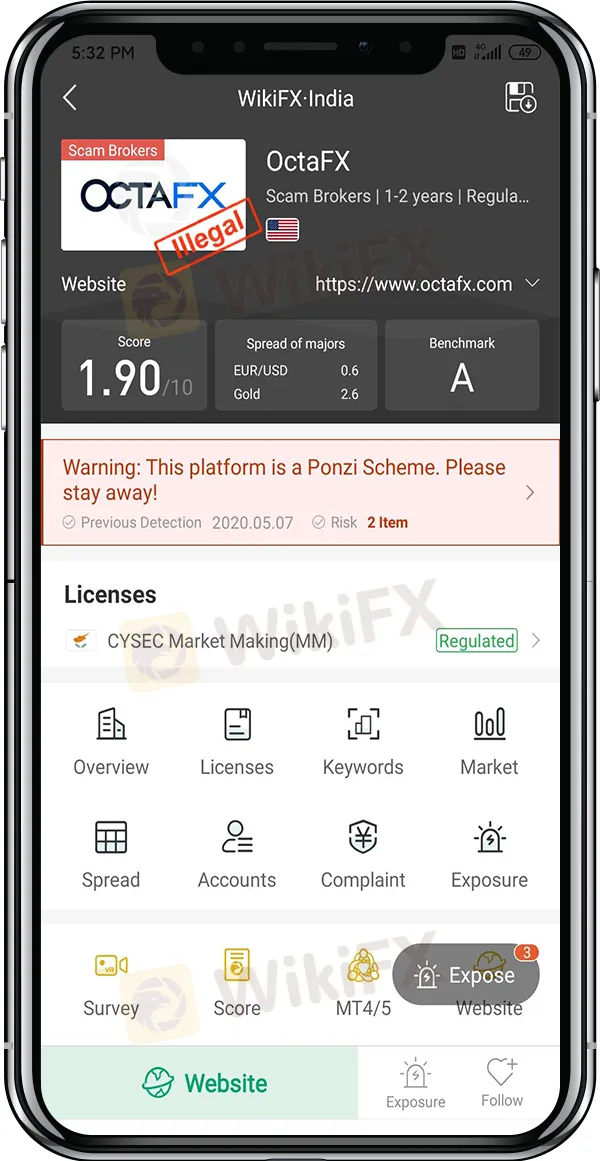

“Best Forex Broker” OctaFX Turned Out to Be “The NO.1 Fraud” ?

Forex

scam keeps occurring recently, causing complaints against the brokers.

Even OctaFX, which calls itself the "best forex broker", has been

repeatedly criticized by investors and was even referred to as the

"number one fraud company".To get more news about WikiFX, you can visit wikifx official website.

Yesterday, A *** R, an investor from India, told us about his

experience. A *** R started trading currency pairs on the OctaFX

platform at the beginning of 2020, and at first it was either a loss or a

small profit. In March, A *** R made a considerable profit by trading

XAU/USD. But the good luck didn't last for long, as the platform

suddenly stopped XAU/USD trading on March 25th.

On April 9th,

XAU/USD trading was resumed. During this period, A *** R submitted a

withdrawal application because there was no profit, but unexpectedly,

his application was immediately rejected by the system, and his

following withdrawal requests remained "under review".

When waiting for the matter to resolve, A *** R eventually lost his

US$75,000 account balance. "Whether you make a profit or loss, money

always belongs to the broker and you will never get it," A *** R

concluded, saying that blinded by the desire to make an instant fortune,

he did not check OctaFX's qualifications in before investing.

According to WikiFX App risk reminder, OctaFX has been intensively

complained in the past month, and has been listed as an illegal broker

by WikiFX, with a score of only 1.90 points. The broker has a very short

history, holding CySEC MM license for less than 2 years. Investors

should watch out for it.

So far, WikiFX App has included profiles of

over 18,000 forex brokers around the world, while integrating broker

information query, exposure, news feed and other functions, offering

investors 24/7 services.

To report illegal traders, please contact

WikiFX official customer service at [email protected], or make an

exposure immediately through WikiFX App https://bit.ly/3ajawKO

Indian Rupee Faces Challenge as Credit Spread Widens

May 17th,

from WikiFX. India's credit spread has widened year to date, hovering

around 260 basis points which can put Indian rupee in a difficult

situation in the coming weeks.To get more news about WikiFX, you can visit wikifx official website.

Markit India Manufacturing PMI and Services PMI both hit a record low

in April, at 27.4 and 5.4 respectively. A reading below 50 usually

indicates shrinking business activities.

According to a survey by

the Indian Economic Supervision Center (CMIE), the unemployment rate in

India will reach a record high of 27.1%. In order to help the Indian

economy severely affected by the epidemic, the Indian authorities have

taken action in fiscal and monetary policies. To date, stimulus measures

of about 1.7 trillion Indian rupees have been implemented, accounting

for about 0.8% of GDP.

India's credit spread has widened year to

date, hovering around 260 basis points. This credit spread is basically

the difference in yield between Indian AAA corporate bonds and the

sovereign government bonds of the same level.

With rising global

economic uncertainties and the possibility for India to lift social

distancing measures, the Indian rupee may face difficulties in the

coming weeks.

Global Infrared Thermometers Market Report 2020

As the most demanded medical product during the COVID-19 pandemic, Infrared Thermometers are projected to reach a global market size of US$1.4 billion by 2027.To get more news about Face Recognition Thermometer Terminal, you can visit jiminate official website.

This simple medical instrument available over- the-counter (OTC) is witnessing a sudden surge in demand as temperature screening and monitoring becomes more popular, prominent and even mandatory in countries worldwide. With fever being a telltale symptom of COVID-19, the beginning of the pandemic witnessed all airport authorities worldwide deploy infrared thermometer guns to screen for sick passengers. With the pandemic spreading and with most countries experiencing community spread, the practice of fever detection has become more widespread.

Currently, supermarkets, shopping malls, offices and all other public spaces have begun scanning customer temperatures to identify and isolate COVID-19 patients. Use of thermometers among public health officials has also skyrocketed with governments imposing mandatory screening, contact tracing and strict quarantine for people with COVID-19 symptoms.

Even consumers are stepping up their spending on medical essentials such as hand sanitizers, medical masks, gloves, vitamin supplements and thermometers. OTC purchases of thermometers have therefore spiked significantly since the start of the pandemic. Especially benefiting are infrared thermometers given their non-contact use which is valuable given the highly transmissible nature of COVID-19 via infected surfaces and physical contact. Until a vaccine is ready, temperature monitoring will be the new norm and will become as commonplace as security checks after the 9/11 attacks.

An infrared thermometer, being easy to use and

accurate, is utilized for measuring temperature without physical contact

and could be easily and correctly calibrated without much effort.

Infrared thermometers offer more accurate and reliable results in

comparison to conventional thermometers. An infrared thermometer deduces

temperature from a part of thermal radiation, also referred as

black-body radiation, that the object required to be measured emits. An

infrared thermometer is occasionally also referred as temperature gun or

non-contact thermometer due to its ability of measuring temperature

through a distance; while at times the thermometer is referred as laser

thermometer since a laser is utilized for aiming the thermometer.

In

the post COVID-19 period innovation will emerge to spur new growth

opportunities. A noteworthy innovation already brought to the market is a

next-generation, smart infrared thermometer developed in Taiwan

integrated with artificial intelligence (AI) to reduce erroneous

readings. The AI feature enables the device to measure temperatures by

detecting people's faces. This reduces errors owing to interference from

radiation emitted by objects held in an individual's hand being

screened.

Another notable innovation is the launch of non-contact forehead infrared thermometer developed by DeltaTrak. The new solution is expected to play a vital role in tackling the challenges arising from the spread of corona virus. The FDA approved device provides instant temperature readings without making any physical contact with the individual being screened. The innovative COVID-19 risk prevention solution is primarily designed to reduce cross contamination and improve safety while conducting daily preventive protection processes in large workforce environments.

Which type of thermometer works best?

Checking your temperature before going to work, school or restaurants is part of the new normal during the pandemic.To get more news about Non-contact face thermometer, you can visit jiminate official website.

But what kind of thermometer gives the most accurate screening?

Infrared thermometers are a considered pretty effective way to check someone’s skin temperature while maintaining social distancing.

But according to Augusta University chief of infectious disease Dr. Jose Vazquez, there are some caveats.The importance of that is really minimal when you are looking for COVID because less than 50 percent of COVID patients actually have a fever,” he said.

But when it comes to thermometers, he said: “The oral ones are more accurate. ... They take more of a central temperature.”

When we put them to the test, an oral thermometer gave a temperature reading of 94.9, but a no-contact infrared thermometer came back with 97.3.Vazquez says certain factors must be taken into account because the temperature of your skin surface may vary.

“If you are in your car and you have the air conditioner going full blast into your face or into your forehead, and you get out and take the temperature on your forehead, then yeah, it’s going to be a lot lower,” he said.

Or if you’re outside in 100-degree weather and you take a walk around the block before getting your temperature taken, it will probably be elevated.

He says although thermometers are a great way to quickly screen a crowd of people, you’re not guaranteed the best results.