wisepowder's blog

After taking a hit in the first two quarters due to the COVID-19 outbreak, China's economy is expected to see a recovery this year, an International Monetary Fund (IMF) official has said.To get more economy news today, you can visit shine news official website.

According to IMF report, China's economy is expected to grow 1.9 percent this year, almost twice as much as previously forecast. IMF tagged the superpower as the only major nation likely to expand in the face of the coronavirus. However, it warned that with other countries and crucial markets still struggling to overcome the pandemic, the road ahead remained bumpy, while a standoff with the US on various issues posed a threat to the global recovery.In an update to its World Economic Outlook on Tuesday, the IMF said it now sees annual growth of 1.9 percent, compared with its earlier prediction of one percent in June.

China's exports have "recovered from deep declines earlier in the year, supported by an earlier restart of activity", the IMF report said.A "strong pickup in external demand for medical equipment and for equipment to support the shift to remote working", also boosted exports. Chinese customs authorities on Tuesday said exports jumped 9.9 percent on-year in September, initially spurred by worldwide demand for Made-In-China personal protective equipment but now widening to household appliances and plastics. China is the only major economy with a positive growth forecast for this year, according to the Fund. "While recovery in China has been faster than expected, the global economy's long ascent back to pre-pandemic levels of activity remains prone to setbacks," the IMF said. The body warned that the world faced a "long, hard, dire" path to post-pandemic recovery and slashed its annual forecasts further, predicting the global economy would shrink 5.2 percent, compared with a 4.9 percent contraction predicted in June. The prolonged US-China trade war that has tipped into a bitter battle for global tech supremacy also threatened to undermine global recovery, IMF said. As part of a partial trade truce signed in January, Beijing promised to import an additional $200 billion in American products over two years, ranging from cars to machinery and oil to farm products.

But the pandemic has put pressure on the agreement and China's purchases of those goods has been lagging. The IMF warned that "tensions between the world’s two largest economies remain elevated on numerous fronts" as Beijing and Washington also lock horns over China's treatment of ethnic minorities in Xinjiang and Beijing's security clampdown in Hong Kong. China is still battling localised coronavirus outbreaks, but has largely curbed its spread, allowing most businesses including cinemas and hotels to reopen and domestic tourists to travel.

The novel coronavirus pandemic has unleashed an immense shock to the global economy. In Europe, the gross domestic product among the countries that use the euro has dropped by over 12 percent while unemployment rates have risen to nearly 8 percent. Many countries are unlikely to reach pre-pandemic levels of gross domestic product until 2022 or later.To get more Shanghai economy news, you can visit shine news official website.

China may take advantage of the crisis — just as it did in the wake of the global financial crisis of 2007 to 2008 — to advance its geopolitical and economic interests in Europe. While the European Union put together a 750 million euros ($878 million) pandemic recovery package this July — demonstrating more advanced crisis management capabilities than it has during past Eurozone crises — the continent is still struggling. Beijing may use its sovereign wealth fund as well as nominally private Chinese companies to act as lenders of last resort in Europe, building Beijing’s soft power at Washington’s expense.

Given China’s assertive turn in its foreign policy, it may use this influence to splinter Western solidarity on issues like Taiwan, Hong Kong, and the South China Sea. Additionally, China is likely to use its economic statecraft to acquire sensitive dual-use technologies through the purchase of AI or robotics firms, and purchase infrastructure that is important to U.S. and allied military forces operating in or through Europe. To be clear, much of the Chinese-origin foreign direct investment in Europe is not of national security concern. By one estimate though, as much as half of China’s foreign direct investment in Europe could be considered to pose a security risk. Whether Europe is prepared and able to parry Beijing’s moves is somewhat unclear, given varied attitudes toward China and the patchwork of investment screening mechanisms across the continent. Regardless, the outcomes will have significant implications for U.S. security. In the wake of the global financial crisis over a decade ago, Chinese investment in Europe exploded.

In 2008, Chinese outward foreign direct investment in Europe was valued at just 700 million euros — by 2016, that amount had grown to 37.3 billion euros. These investments brought much needed capital to the cash-strapped continent. Chinese investors — both public and private — were drawn to Europe for several reasons, including the undervaluation of European assets and the friendlier investment climate relative to the United States. Chinese investments were mostly concentrated in a few key countries, with the United Kingdom (30 percent), France (18 percent), Germany (13 percent), and Italy (11 percent) receiving the lion’s share. Most of these investments were made by Chinese state-owned enterprises or its sovereign wealth fund, which are directly tied to the central government and hence to the Chinese Communist Party. Ostensibly, private Chinese firms have increasingly invested in Europe as well, but China’s 2017 national security law effectively blurred the line between private entities and the Chinese state.

There is some evidence that China’s investment boom in Europe paid geopolitical dividends. Beijing might now again take advantage of Europe’s economic position in the aftermath of the novel coronavirus to build soft power, obtain sensitive technologies, or acquire militarily significant infrastructure. The question confronting Europe, as well as the United States, is whether it is prepared to respond any differently to Beijing’s use of economic statecraft than it did in the wake of the last economic crisis.

Shanghai increased airport screening on Saturday as imported coronavirus infections from countries such as Italy and Iran emerge as the biggest source of new cases in China outside Hubei, the province where the outbreak originated.To get more latest Shanghai news, you can visit shine news official website.

Mainland China had 99 new confirmed cases on Friday, according to official data. Of the 25 that were outside Hubei, 24 came from outside China. Shanghai, which had three new cases that originated from abroad on Friday, said it would step up control measures at the border, which had become “the main battlefield”.At a news conference, Shanghai Customs officials said they city would check all passengers from seriously affected countries for the virus, among other airport measures. Shanghai already requires passengers flying in from such countries, regardless of nationality, to be quarantined for 14 days. They will now be escorted home in vehicles provided by the government. Tighter screening has greatly lengthened waiting times at Shanghai’s Pudong International Airport - some passengers say they have had to wait as long as seven hours.The Shanghai government vowed on Saturday to severely punish passengers who concealed infections.

Beijing police said on Saturday they would work with other departments to prevent imported infections. They said some members of a Chinese family flying in from Italy on March 4 had failed to fill in health declarations accurately, and later tested positive for the virus. In addition to the growing risk of imported infections, China faces a challenge in trying to get migrant workers back to work by early April. So far, 78 million migrant workers, or 60% of those who left for the Lunar New Year holiday in January, have returned to work. Yang Wenzhuang of the National Health Commission (NHC) said that the “risk of contagion from increased population flows and gathering is increasing ... We must not relax or lower the bar for virus control”. But new cases in mainland China continued to decline, with just 99 new cases on Friday, the lowest number the NHC started publishing nationwide figures on Jan. 20, against 143 on Thursday.

Most of these cases, which include infections of Chinese nationals who caught the virus abroad, were in the northwesterly Gansu province, among quarantined passengers who flew into the provincial capital Lanzhou from Iran between March 2 and 5. For the second day in a row, there were no new infections in Hubei outside the provincial capital Wuhan, where new cases fell to the lowest level since Jan. 25.The total number of confirmed cases in mainland China so far is 80,651, with 3,070 deaths, up by 28 from Thursday.

Bank of England Is Assessing Negative Rate Policy

May 25th from

WikiFX News. Bank of England Governor Andrew Bailey change his comment

last week that negative rate “is not an approach we‘re considering or

planning to take” and said it’s the right time to review and assess all

policy tools, indicating that the Bank of England is urgently evaluating

the possibility of introducing negative rate.To get more news about WikiFX, you can visit wikifx official website.

Giving the green light to negative rate doesnt mean the central bank

will immediately adopt a rate below zero. What the central bank is doing

right now is planning for the next step after a potential shock in the

future, and the pandemic accelerated the process. Currently the central

bank is relying on QE as the main stimulus approach, the government has a

rising demand for borrowing, and a risk of further shrinking economy

also confirms the need for easing policies.

With the government launching unprecedented measures to prevent

possible economic breakdown due to the pandemic, Britain‘s budget

deficit in April climbed to an unprecedented high since the modern

record was established in 1993, with central government spending surging

57% and income falling 27%. Even during the financial crisis, Britain’s

monthly borrowing had never exceeded 22 billion pounds.

WikiFX Visited Forex Broker xtrade in Australia

Regulatory

information shows that trader xtrade's Australian office is located at

‘St Kilda Road Towers’, 1 Queens Road, MELBOURNE VIC 3004.To get more

news about WikiFX, you can visit wikifx official website.

WikiFX survey team learned that ‘St Kilda Road Towers’ at Queens Road

1 is a 15-story business complex located in one of Melbourne's most

prestigious commercial zones. It is accessible via all major arterial

roads and a short walk from Melbourne CBD.

We drove to ‘St Kilda Road Towers’, which stood out among the nearby

parks and golf courses. Entering the office building, we found our

destination xtrade on the floor map. After we arrived at xtrade's

office, we had a brief communication with the staff, who welcomed us and

allowed us to film part of their work scene. Most of the company's

staff were busily working at the time. We conclude that the office of

xtrade in Australia truly exists.

Xtrade has more than 10 years of

experience in the industry, providing financial trading services in

stocks, commodities, forex and index CFDs. At xtrade, customer funds are

isolated and protected in reputable credit institutions. Per

investigation, xtrade holds MM license granted by ASIC and is fully

qualified for forex brokerage business.

According to WikiFX App,

the broker xtrade is currently in valid regulation holding MM license

issued by ASIC, Rated at 7.48, xtrade has acceptable credibility. But as

it has received several complaints in the past three months, investors

still need to beware of the risks in choosing the broker.

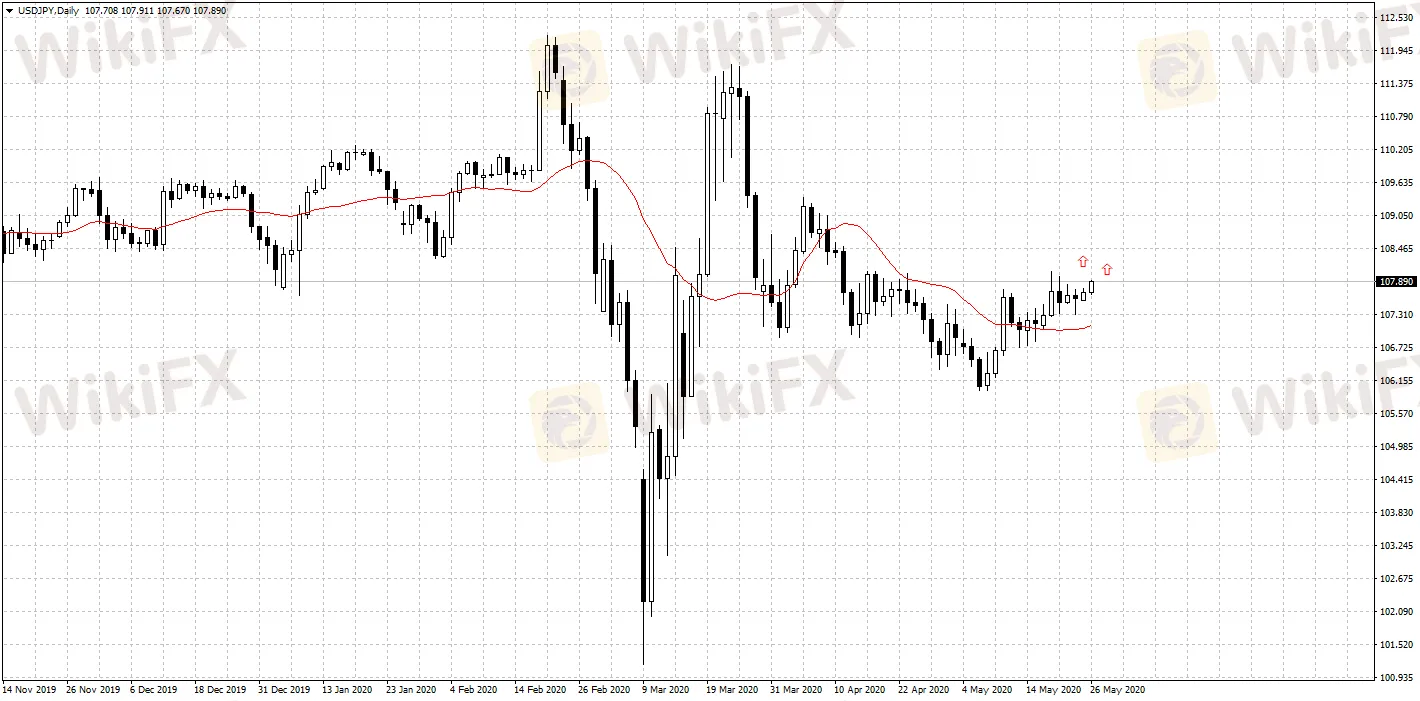

Yen Depreciates as Japan Again Launches Stimulus

May 26th, from

WikiFX News. Japan is considering a new round of stimulus scheme worth

of 100 trillion yen(US$929.45 billion), which includes financial aid

programs for businesses under the shock of coronavirus pandemic.To get

more news about WikiFX, you can visit wikifx official website.

The scheme will be funded by the second extra budget of the fiscal year starting this April.

According to Nikkei News, this will be the second massive stimulus

kicked off by the Japanese government after the record-breaking US$1.1

trillion spending plan launched last month, which focused on cash

assistance for households and loans to small businesses hit by the

pandemic.

We estimate Japanese governments economic stimulus will drive down

the price of the yen, which has also been reflected in the latest change

of forex market positions. As of May 19th, speculative net longs in JPY

decreased by 467 to 27,470 contracts, with speculative longs dropping

4,269 to 52,038 contracts and speculative shorts down by 3,802 to 24,568

contracts.

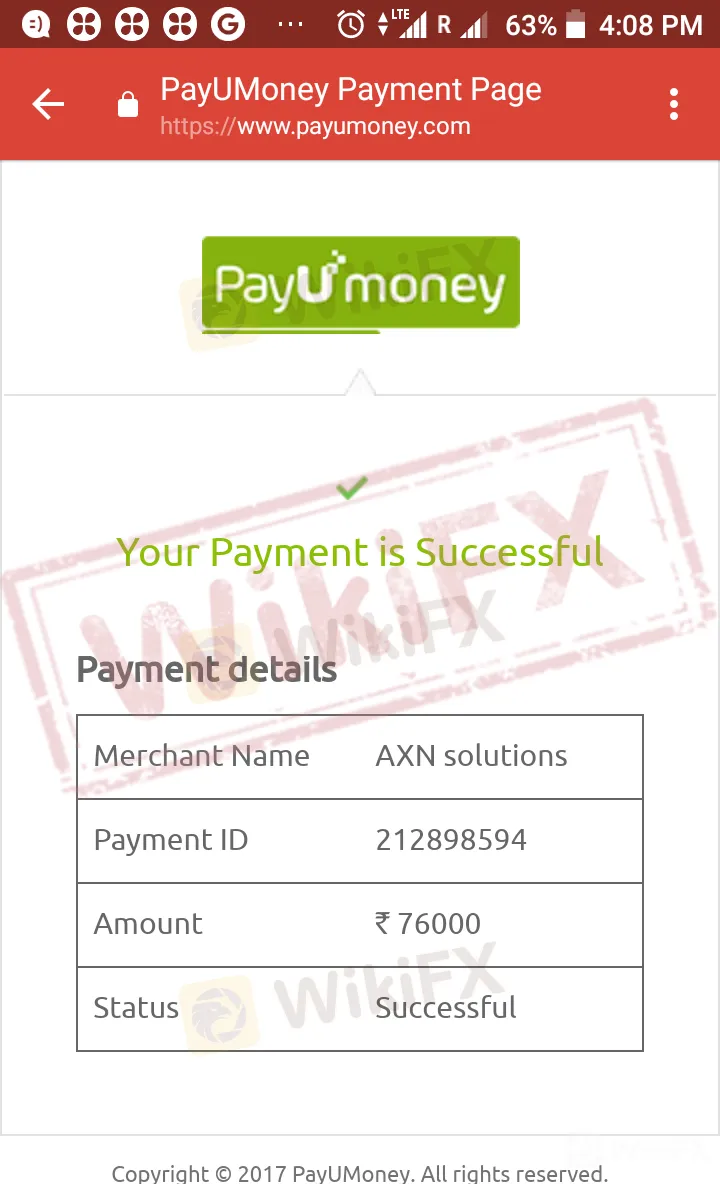

Illegal AXNFX Suspended Investor’s Account for No Reason

Recently,

WikiFX got a complaint against the illegal broker AXNFX from an Indian

investor, who suffered great losses after the broker suspended his

account for no reason. The following is his story.To get more news about

WikiFX, you can visit wikifx official website.

Event recap

The investor opened an account with a balance of US$140. But after

the first few transactions, the platform showed that the investors

account may be closed due to some errors in the trading process. A

client manager named Vincent then offered him a discount and persuaded

the investor into making more deposits in order to secure the trading

account with a low account net worth.

For the next 6 months,

investor eventually totaled his investment to US$7,500, with an account

balance of US$ 82,000 and a net worth of US$30,000. Then the investor

decided to withdraw part of his balance, and Vincent, the client

manager, suggested him to break down his withdrawal into several smaller

sums. So the investor applied to withdraw US$2,000 and US$2,500

separately, but he didn‘t got the US$2,500 withdrawal after receiving

US$2,000, and what’s worse, while waiting for the money he found his

account was closed by the client manager, leaving the rest of his

account balance inaccessible. Currently the investor cant withdraw his

remaining balance and suffered a total loss of US$14,000.

Per checking AXNFX‘s website, WikiFX failed to find any of the

broker’s regulatory information among its numerous highlights listed by

the broker itself. As AXNFX was registered in Seychelles, WikiFX also

checked the website of Seychelles‘ regulation authorities and still

couldn’t find AXNFXs regulatory information.

Finding Discarded Lottery Ticket

A couple from Louisiana have

more than a million reasons to be grateful this Thanksgiving after

discovering a long-lost a jackpot-winning lottery ticket with only two

weeks left to claim it.Get more news about 彩票包网,you can vist nb68.com

Harold and Tina Ehrenberg found the $1.8 million winning ticket, which

won the southern US state's June 6 Lottery Lotto draw, while doing some

holiday cleaning.

"We have family coming into town for Thanksgiving,

so I was cleaning up the house and found a few lottery tickets on my

nightstand that we hadn't checked," Tina said, according to a statement

by Louisiana Lottery.

The couple checked the Lottery's website and

soon found one of the tickets matched all of the numbers listed, and

were able to claim their prize with just two weeks remaining of the

180-day limit

After state and federal taxes, the Ehrenbergs take home $1,274,313, which they plan to put away for their retirement.

"We don't have any plans to buy anything crazy or go on any big trips," Tina said.

A single winner in the South Carolina town of Simpsonville took home a

massive $1.5 billion in the Mega Millions US lottery jackpot last month,

dwarfing a previous record set in March 2012 at $656 million.

Canadian Couple Find Lost Lottery Ticket Brought on Valentine's Day to Win Millions

A

Quebec couple won 1 million Canadian dollar (4750,000) in the lottery

after finding a winning ticket that had been forgotten in a book for

months, the province's Loto-Quebec organization said Wednesday.

Nicole Pedneault and Roger Larocque only realized last weekend that they

had a winning ticket from an April 5, 2018 drawing.While looking

through a book about Japan to help her grandson with a school project,

Pedneault noticed something had fallen from the pages.Get more news

about 菲律宾牛博包网,you can vist nb68.com

It was a lottery ticket the couple had bought for Valentine's Day last year.

"If my grandson hadn't asked me to give him some things for his

presentation, I wouldn't have ever found the ticket," Pedneault said.

"The first thing I did when I found the ticket in the book was go look

at the deadline for claiming winnings on the Loto-Quebec website," she

said.

Man Plays Lottery Game for 25 Times

According to the official

Virginia Lottery website, a man named Raymond Harrington won 25 plays in

the same Virginia Pick 4 lottery game. The said person had purchased 25

identical tickets each worth $1. Each of these tickets had the exact

same four digit combination of 4-6-4-0. As per the official website,

each of these tickets had won the top prize.Get more news about 天下包网平台,you can vist loto98.com

Raymond has currently won a total of $1,25,000 (Rs 93.7) lakhs. Each ticket had the top prize of $5000.

As per a report published in the Times Now, the lottery winner will be

investing in his son’s college education. Speaking about what made him

take such an unusual step, he said, "something just told me to play 25

times".

He had purchased the tickets from, "Wegnam's store in Virginia Beach".

Such incidents in the world of lottery are rare but not unusual.

Back in April, a person named Joe B had won a price worth one million

two times in a single day. The man belonging to Pueblo in Colorado, won

two Powerball prizes on March 25. He was only able to claim his won

money a month after he actually won the prize. This was because of the

widespread, of the novel coronavirus.